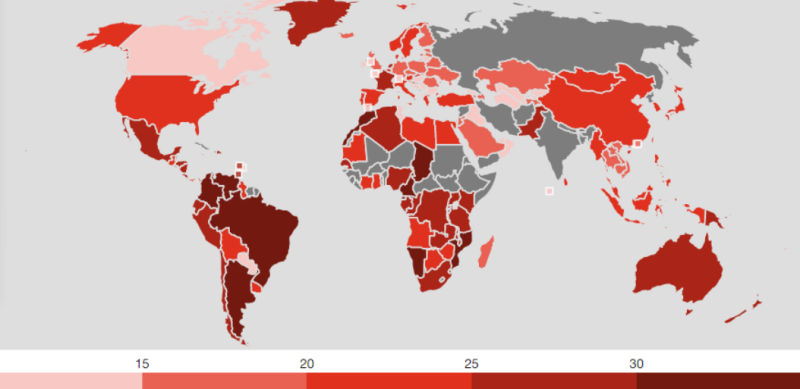

When you search key words such as “China” and “Tax”, it is very easy to find out the comments saying that China is a heavily taxed country especially on enterprises. This can be shown in the latest PWC statistics chart.

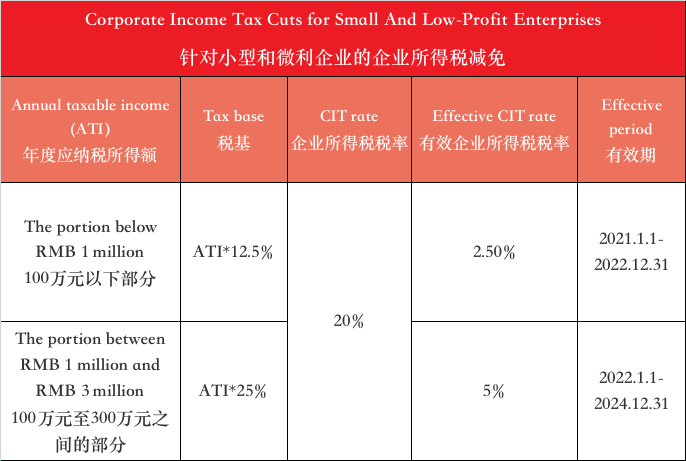

The nominal Corporate Income Tax (CIT) is 25%. However, when you look closely into the latest tax policies especially on small and median sized enterprises, the CIT is very low. Let’s have a look of the specifics:

名义企业所得税(CIT)为25%。然而,当你仔细研究最新的税收政策,尤其是针对中小企业的税收政策时,CIT非常低。让我们看看具体情况:

CIT incentives for small and low-profit enterprises (SLPEs)

针对小型和微利企业(SLPE)的CIT激励措施

China has recently enhanced its inclusive tax cut policy for small and low-profit enterprises. SLPEs refer to enterprises engaged in non-restrictive and non-prohibited businesses that meet the following three conditions:

●Annual taxable income not exceeding RMB 3 million (approx. US$458,500);

● Number of employees not exceeding 300;

●Total asset value not exceeding RMB 50 million (approx. US$7.7 million).

中国最近加强了针对小型微利企业的普惠性减税政策。小型微利企业是指从事非限制性和非禁止性业务的企业,符合以下三个条件:

● 年应纳税所得额不超过300万元人民币(约45.85万美元);

● 员工人数不超过300人;

● 总资产价值不超过5000万元人民币(约770万美元)。

All types of SLPEs in China are able to enjoy a reduced corporate income tax (CIT) rate of 20 percent in combination with a reduction of their tax base.

中国所有类型的小型微利企业都可以享受20%的企业所得税(CIT)税率的降低,同时降低其税基。

Specifically, SLPEs are subject to:

● 20 percent CIT rate on 12.5 percent of the taxable income amount for the portion of taxable income not exceeding RMB 1 million (approx. US$152,800) (effective from Jan. 1, 2021-Dec. 31, 2022);

● 20 percent CIT rate on 25 percent of their taxable income amount for the portion of taxable income more than RMB 1 million but not exceeding RMB 3 million (effective from Jan. 1, 2022-Dec. 31, 2024)

具体而言,小型微利企业受以下约束:

● 应纳税所得额不超过100万元人民币(约15.28万美元)的部分,按应纳税所得额的12.5%计算20%的企业所得税税率(自2021年1月1日至2022年12月31日生效);

● 对于应纳税所得额超过100万元但不超过300万元的部分,按其应纳税所得额的25%征收20%的企业所得税税率(自2022年1月1日至2024年12月31日生效)

As a result, for an SLPE’s taxable income amount up to RMB 1 million, an effective 2.5 percent CIT rate applies; for the portion of taxable income between RMB 1 million and RMB 3 million, an effective 5 percent CIT rate applies.

因此,对于小型微利企业的应纳税所得额不超过100万元人民币的,适用有效的2.5%的CIT税率;应纳税所得额在100万元至300万元之间的部分,适用有效的5%的企业所得税税率。

Because the SLPE evaluation is carried out at the entity level (instead of at the group level), small subsidiaries of foreign multinational enterprises (MNEs) in China can also benefit from these CIT cuts.

由于小型微利企业评估是在实体层面(而非集团层面)进行的,外国跨国企业(MNE)在中国的小型子公司也可以从这些CIT削减中受益。

It is clear that for SLPEs current effective tax rate is very favourable. In addition to VAT exemption we discussed in the last article, taxation shall not be your concern when considering starting a SME in China.

很明显,对于小型微利企业而言,当前的有效税率非常有利。除了我们在上一篇文章中讨论的增值税豁免之外,在考虑在中国开办中小企业时,您不必担心税收问题。

Our point is, after you registered an enterprise in China as a start up, don’t worry about booking your expenses and loss on your company account, and don’t hesitate to inject capital from overseas to cover your expenses. It is common for start up to have limited or zero income but all costs. As owner and employee, you can also withdraw salary as part of your business cost.

我们的观点是,当你在中国注册一家初创企业后,不要担心在你的公司账户上记下你的费用和损失,也不要犹豫从海外注资来弥补你的费用。创业公司通常收入有限或零,但成本全无。作为所有者和雇员,你也可以提取工资作为你业务成本的一部分。

All that activities will not affect your company tax status. Of course if your salary to be paid by your company account, then individual income tax is applicable.

所有这些活动都不会影响您的公司税务状况。当然,如果你的工资由你的公司账户支付,那么个人所得税是适用的。

In the end, Reindeer Station kindly advice to run the business by engage in some activities, presenting normal operation rather than total silence after registration.

最后,灵达商务善意地建议通过开展一些活动来经营业务,在注册后呈现正常运营,而不是完全静默。